Free credit scr

There are multiple credit scoring models which means that a good credit score can be different depending on the scoring model being used.

All casino to play real money online

Credit scores can range between 300 and 850. A good credit score generally starts at 700, and a score of 800 or above is considered excellent. Checking your free credit score is considered a soft inquiry. Soft inquiries are not a factor in credit scoring models and therefore donвђ™t impact your credit scores.

Free credit score

Get your FICO ® score * for free and see how you might look to a lender.

* credit score calculated based on FICO ® score 8 model. Your lender or insurer may use a different FICO ® score than FICO ® score 8, or another type of credit score altogether. Learn more.

Why check your credit score with experian?

Credit score factors

View the specific score factors that are impacting your FICO ® score.

Your credit score is calculated from the information found in your credit report. See the factors influencing your FICO ® score, including payment history, amount of debt, credit history length, amount of new credit, and credit mix.

Credit score tracking

FICO ® score tracking powered by experian data.

With an interactive FICO ® score tracker, you can visualize your progress over time and receive customized alerts when your score or rating change.

Boost your credit scores

Raise your FICO ® score instantly for free with experian boost

Get credit for your phone and utility bills by adding positive payments to your experian credit file. Other services such as credit repair may cost you thousands of dollars and only help remove inaccuracies from your credit report.

Credit cards matched for you

See personalized credit card and loan offers based on your credit score with creditmatch.

Use creditmatch to compare credit card rates, rewards, fees, and other details to find the right card right for you.

Credit score resources

How good is a credit score of 660?

How often does your credit score change?

Why do I only have a credit score with one credit bureau?

Credit advice

What is a credit score?

A credit score is a number generated by an algorithm using the information in your credit report and is usually updated each month. Lenders and other service providers use credit scores to indicate your creditworthiness and how likely you are to repay a loan on time.

What is a good credit score?

There are multiple credit scoring models which means that a good credit score can be different depending on the scoring model being used. Credit scores can range between 300 and 850. A good credit score generally starts at 700, and a score of 800 or above is considered excellent.

One of the most well-known credit scores is the FICO ® scores. A good FICO ® score starts at 670. The higher your credit score is, the better your chances are to be approved for a loan with better rates.

Why is checking your credit score important?

Checking your free credit score can be a good indicator of where your credit stands and whether you need to work towards improving your score. Lenders such as credit card companies, banks, and car dealerships providing auto loans use credit scores along with other criteria to decide whether to approve you for credit. Knowing your credit score before applying for a loan or any type of credit can help you better prepare and eliminate surprises such as unfavorable terms or even denial.

How to improve your credit score

Improving your credit score can take time but the sooner you address the factors affecting your credit, the faster your score will increase. You can increase your scores by taking the necessary steps, like paying bills on time, keeping your credit utilization ratio low, and paying down debt. It can also be a good idea to keep unused credit cards open and only apply for new credit accounts when necessary. Finally, you might want to make sure your credit reports donвђ™t contain any inaccuracies that can potentially hurt your scores.

Another effective way to raise your credit score quickly is by using tools like experian boost TM , which allows you to add utility and telecom bills to your credit file. It could give your credit score an immediate increase that can be especially helpful to those struggling with building credit.

What can impact my credit score?

Your credit score can be affected by a number of factors and while the exact criteria can vary by scoring model, the most influential factor is typically your payment history. Even one missed payment can have a negative effect on your score.

Your credit utilization ratio also plays a big factor in determining your score. Itвђ™s solely based on your revolving credit and measured by how much of your available credit youвђ™re using.

Credit scoring models look at the number, types and age of accounts you have. Maintaining a good mix of credit and positive history shows that you are able to handle new credit responsibly.

Although hard inquiries donвђ™t make a huge impact on your score, they can temporarily lower it. Hard inquiries stay on a credit report for 2 years, but in general, the impact to your FICO score will lessen after 1 year.

Lastly, negative information on your credit such as late or missed payments, foreclosures, collection accounts, and charge-offs can negatively impact your credit.

Does checking my free credit score hurt my score?

Checking your free credit score is considered a soft inquiry. Soft inquiries are not a factor in credit scoring models and therefore donвђ™t impact your credit scores.

Why did my credit score drop?

Credit scores change all the time. If you notice that your scores went down, there may be a few reasons why. For example, your score could have dropped if you have a late or missed payment or recently applied for a new loan or credit card. Other possible reasons include increased credit utilization, closing an account, or a new derogatory mark on your report. Checking your free credit score can help you narrow down why your credit score may have dropped.

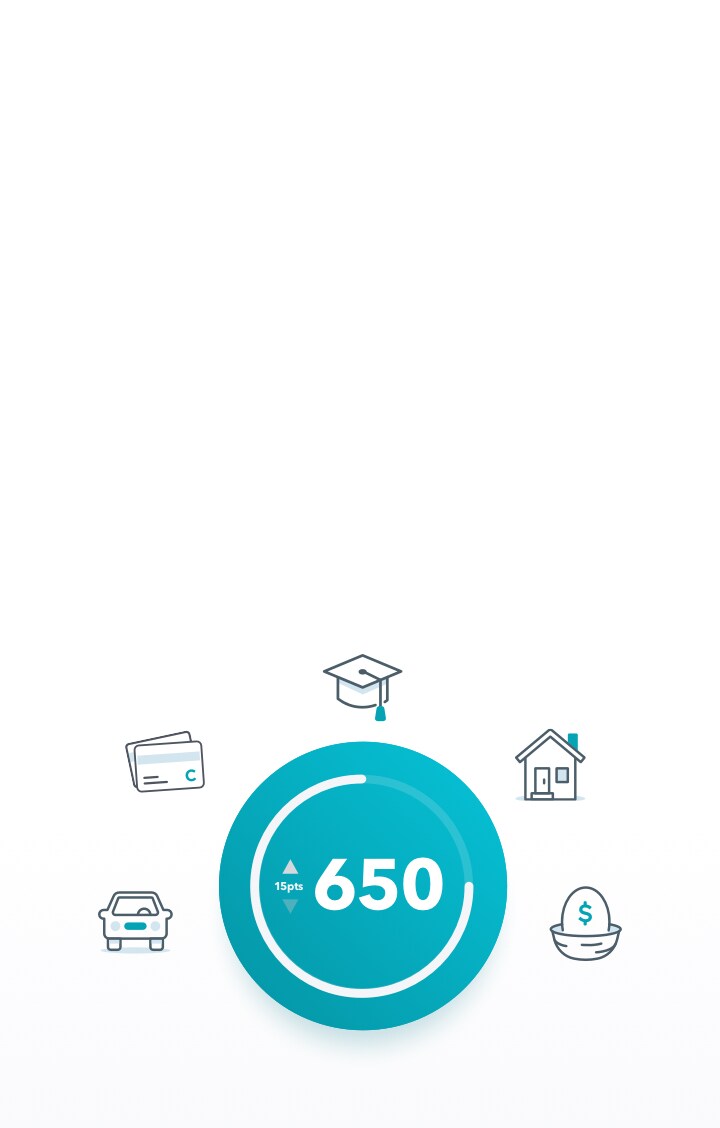

Unlock more of what

you want with your

free credit score

Your credit score plays a big role in how lenders determine your interest rates

and how much you can borrow. Maintaining a good credit score can be the

key to getting the things

you want in life,

from a credit card or a car loan to

a

home mortgage.

Why use turbo for

your

credit score?

Turbo provides you with an easy-to-read breakdown of your

credit score and updates it once a month, making it simple to

see where you stand today. And with turbo you can view your

credit report at any time, without it impacting

your credit score.

Small steps. Big improvements.

Getting a copy of your credit report is the first step toward improving your credit score.

Here’s a few additional tips that could give your score an additional boost.

Pay your bills on time,

every time

Past payment performance significantly affects your credit score. By paying all of your bills on time every month you

can positively increase how lenders view your future

payment performance.

Keep credit cards open –

even the unused ones

Consider keeping credit cards open – even if you aren’t using them. So long as they don’t have annual fees, keeping those cards open could actually keep your credit utilization ratio lower, and improve your

credit score.

Improve your

credit utilization

Your credit utilization ratio is calculated by adding all of your credit card balances and dividing that number by your total credit limit. Typically, lenders like to see ratios below 30%. By paying off debt and keeping

your credit card balances low

you can positively impact your credit

utilization ratio.

Only apply for

new credit

cards

when needed

When you open new credit cards you trigger hard credit inquiries on your

credit report. Opening new credit card accounts just to have a better credit mix won’t likely improve your score. So only use the credit that you currently have, whenever possible.

Check for incorrect information

on your credit report

Credit reports aren’t necessarily perfect, which is why it’s important to make sure there isn’t any inaccurate information on your credit report. If you see something on your credit report that doesn’t look right, you’ll want to dispute it with your credit report provider (e.G. Transunion) as soon as possible

Increase your

credit limits

If you have a good credit history with your lender, ask your credit card issuer if you can raise your credit limits. This will result in a soft credit check, which won’t impact your credit score. A credit card limit increase may help your credit utilization rate, which can help improve your score.

Your free credit score is here.

A better score can help unlock the things you want — like a great travel credit card, better interest rates, lower insurance premiums and more.

Always know your number (and how to improve it)

Check your score

See your free credit score whenever you like without hurting your credit. Plus, your info is updated every seven days.

Monitor changes

Track your vantagescore® 3.0 and know when things change with 24/7 access to our free credit monitoring tool.

Build over time

Build your credit with personalized tips and a suite of tools. Learn from our expert staff, and trade ideas in our community forum.

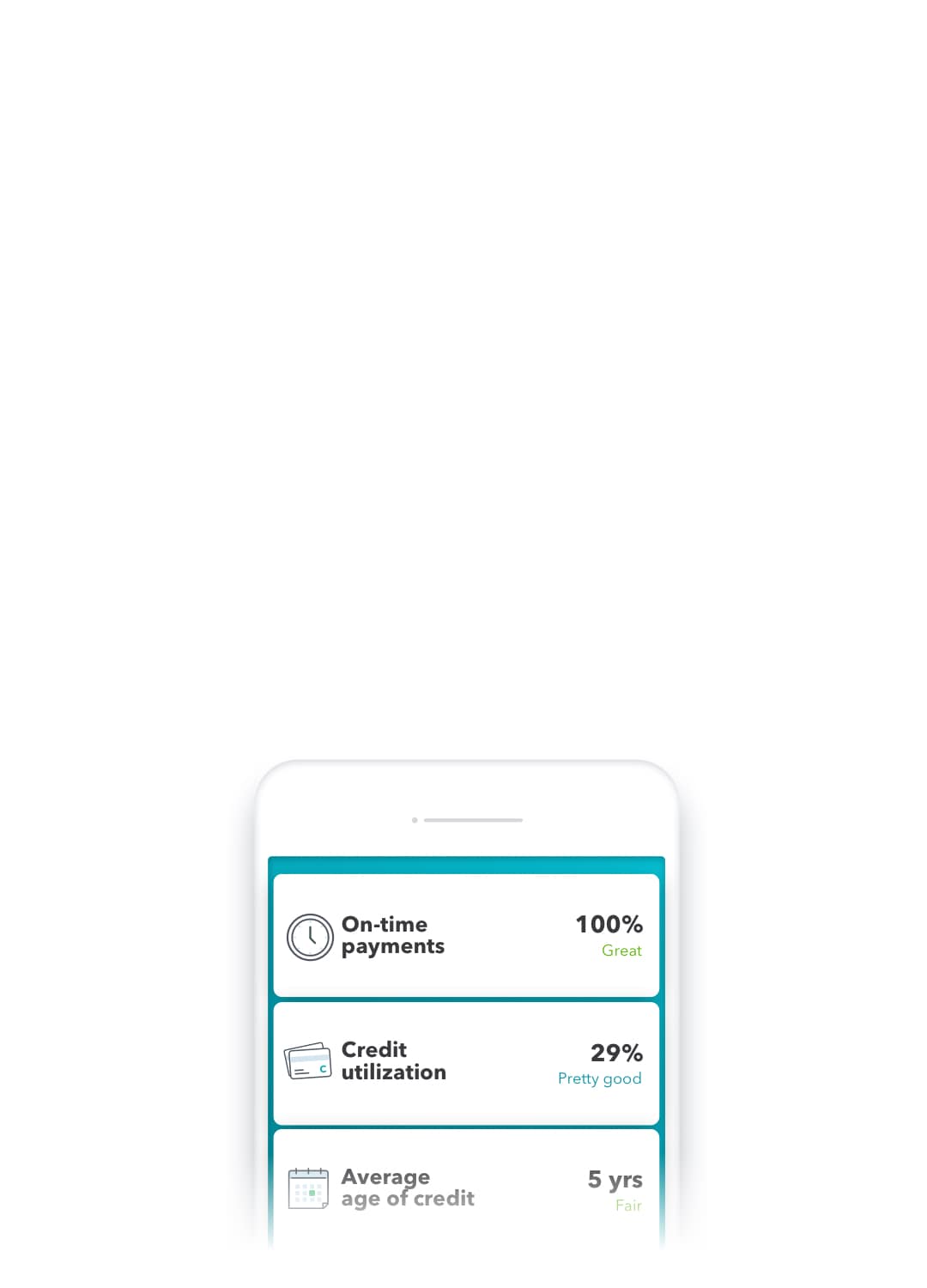

See what powers your credit score

Nerdwallet demystifies the elements of your credit score, pointing out what has the biggest impact and how you’re doing on each. You’ll know what things like “credit utilization” mean — and why it’s a big deal for your score. Expert tips and answers make managing your credit easier than ever.

Add more points

Your credit score simulator lets you see how small shifts can mean big point increases. Explore actions like raising the limits on your cards, applying for new credit or extending your streak of on-time payments.

Make all the right money moves

Join the millions of people who are already using nerdwallet to improve their finances.

Costs you nothing

No credit card required — really. Still not sure? Here’s how we make money.

Private and secure

Rest easy knowing all your info is secured with 128-bit encryption.

Won’t hurt your credit

We use a "soft inquiry" to check your credit score, meaning it won’t be affected.

Frequently asked questions

What is my credit score — and why does it matter?

Information on how you’ve handled debt in the past is translated into a three-digit score predicting how likely you are to repay a future loan or credit card balance. The higher your score, the better you look to potential creditors.

With a low score, you may still be able to get credit, but it will come with higher interest rates or with conditions, such as depositing money to get a secured credit card. You also may have to pay more for car insurance or put down deposits on utilities. Landlords might use your score to decide whether they want you as a tenant.

But as you add points to your score, you'll gain access to more credit products — and pay less to use them. Borrowers with scores above 750 or so have many options, including the ability to qualify for 0% financing on cars and credit cards with 0% introductory interest rates.

What is a good credit score?

The most commonly used credit scoring models range from 300 to 850. Each lender sets its own standards for what constitutes a good credit score. But, in general, scores fall along the following lines:

- 720 and higher: excellent credit

- 690-719: good credit

- 630-689: fair credit

- 629 or lower: bad credit

How can I build my credit score?

The two biggest factors in your score are payment history and credit utilization (how much of your available credit you're using). That’s why they come first in this list of tips:

- Pay all your bills, not just credit cards, on time. Late payments and accounts charged off or sent to collections will hurt your score.

- Use no more than 30% of your credit limit on any card — and even less, if possible. The best scores go to people using 10% or less of their credit limits.

- Keep accounts open and active when possible — that gives you a longer payment history and can help your credit utilization.

- Avoid opening too many new accounts at once. New accounts lower your average account age and each application causes a small ding to your score. We recommend spacing credit applications about 6 months apart.

- Check your credit reports and dispute any errors you find.

What goes into my credit score — and what doesn't?

When you or a lender "check your credit," a scoring model from either FICO® or vantagescore® is applied to the current data in one of your credit reports. Your score will vary, depending on which FICO® or vantagescore® version was used and whether it looked at your credit report from experian®, equifax® or transunion®. It can even vary month to month or day to day as new data get sent to your credit reports.

Nerdwallet uses vantagescore® 3.0 and your transunion® credit report data. Most lending decisions are made using the FICO® model. If you have a good vantagescore®, you may also have a good FICO® score, because both consider much the same factors with some differences in how they weight them:

- Payment history: your record of on-time payments and any negative marks, such as missed payments, accounts sent to collections or bankruptcies.

- Credit utilization: balances you owe and how much of your available credit you're using.

- Age of credit history: how long you've been borrowing money.

- Applications: whether you've applied for a lot of credit recently.

- Type of credit: how many and what kinds of credit accounts you have, such as credit cards, installment debt (such as mortgage and car loans) or a mix.

A credit score does not consider your income, savings or job security. That’s why, in addition to your credit score, lenders also may check what you owe, how much you earn and assets you have accumulated.

How does nerdwallet get my score?

Nerdwallet partners with transunion® to provide your vantagescore® 3.0, based on information in your transunion® credit report. Your score and credit report information is updated weekly. Note that lenders may make their approval decisions using a different credit scoring model or data source.

Is my credit score really free?

Yes! You can sign in to nerdwallet at any time to see your free credit score, your free credit report information and more.

Disclaimer: nerdwallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s terms and conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact transunion® directly.

Property and casualty insurance services offered through nerdwallet insurance services, inc.: licenses

Nerdwallet compare, inc. NMLS ID# 1617539

California: california finance lender loans arranged pursuant to department of business oversight finance lenders license #60DBO-74812

Free credit score report temporarily unavailable

Due to the unforseen impact of COVID-19, we have made the decision to temporarily remove the free credit score report from ratehub. Don't worry, we will still be providing access to all existing credit score reports. Simply log-in to your account and visit the "my profile" section to view your credit score report. If you have any trouble accessing your report, feel free to contact our customer support team.

We apologise for the temporary inconvenience.

It takes less than 3 minutes to complete the online process and see your score instantly.

Checking your own credit score with ratehub.Ca won't affect your score!

We employ the same security encryption that banks use to make sure your information stays safe.

We provide you your score for free. In fact, we won't ask you for your payment information.

How do I get my credit score?

At ratehub.Ca, we believe everyone should have the tools they need to make smart financial decisions when comparing financial products. That's why we've partnered with equifax canada to provide you with your credit score.

Here's how to get your free score:

- Login to ratehub.Ca

- Complete the required ID verification

- Get your credit score

Why is my credit score important?

Your score can impact your ability to quality for a new credit card, loan or mortgage. Whether you are saving for your first home, looking for a new credit card, or hoping to rebuild your credit history, your score is a key factor in the lenders desire to work with you.

Another often overlooked fact is that having a low or high credit score can often be linked directly to the interest rate you will get for certain credit products. Credit cards, and especially loans and mortgages, are directly linkde to your credit history, score and overall financial position.

It's important to know your score so you can make changes necessary so you can make sure you are best positioned in the eyes of the lender.

Why does ratehub.Ca offer my score for free?

Our business model allows everyone to come out on top. It's really simple, and yes, it's really free.

When we provide you with your credit score, you get access to your equifax canada credit score. We in turn use our love of data and analytics to tailor product recommendations that will help you achieve your financial goals. Whether it's building credit, saving for a downpayment, or buying a home. We get paid by bank, lender and credit card partners if you're interested in one of their products.

Thus, there is no cost to you, and you get offers highly customized just for you!

Equifax security breach update

Recently, atlanta-based equifax announced that unauthorized individuals gained access to customer information stored in their database. The following information is provided by equifax:

October 2nd, 2017 - equifax inc. Announced today that the cybersecurity firm mandiant has completed the forensic portion of its investigation of the cybersecurity incident disclosed on september 7 to finalize the consumers potentially impacted.

With respect to potentially impacted canadian citizens, the company previously had stated that there may have been up to 100,000 canadian citizens impacted, but that number was preliminary and did not materialize. The completed review subsequently determined that personal information of approximately 8,000 canadian consumers was impacted. In addition, it also was determined that some of the consumers with affected credit cards announced in the company's initial statement are canadian. The company will mail written notice to all of the potentially impacted canadian citizens.

You can read equifax’s release in its entirety here, and direct any questions to equifax directly by calling 1-866-828-5961.

Ratehub.Ca has partnered with equifax canada since november 2016 to offer our users free credit scores. As one of canada’s two major credit bureaus, your bank, utilities provider or other parties may have used equifax canada to verify your creditworthiness for financial products (like a mortgage or credit card), utilities or for other uses.

Ratehub.Ca servers were not hacked, and ratehub.Ca is still secure and not affected by this security breach.

We encourage you to monitor equifax canada’s website as further details about the hack become available.

If you have any further questions or concerns, they should be directly addressed to equifax by calling them at 1-866-828-5961.

The score provided to you is the equifax risk score, which is also known as ERS 2.0. The equifax credit score is based on equifax’s proprietary model. The provision of this score to you is intended for your own educational use. Lenders will take into consideration other information in addition to a credit score when evaluating your creditworthiness.

What is credit score

A credit score is a measure of an individual’s ability to pay back the borrowed amount. It is the numerical representation of their creditworthiness. A credit score is a 3-digit number that falls in the range of 300-900, 900 being the highest.

Credit scores are calculated by the credit bureaus in the country after taking into consideration several factors like the length of your credit history, repayment records, credit inquiries, among others.

When you apply for a credit card or a loan from a bank of nbfcs, having a higher credit score may entitle you to receive further benefits such as a higher loan amount, lower interest rate and your choice of tenure to repay the loan.

Steps to get your free credit score

- Visit credit score page

- Enter your first and last name.

- Add your mobile number and e-mail ID.

- An OTP will be sent to your mobile number for verification.

- The next step would be to verify your age.

- Your credit score and your report will be then displayed on the screen.

Credit score range and what it means

A credit score ranges between 300-900. You should always take measure to bring your credit score closer to 900. A higher credit score increases your chances of getting a good deal on loans as well as credit cards. Let’s take a look at the different credit score range:

- NA/NH : in order to calculate your credit score, you need to have a credit history. If you have no credit history, your credit report will mention that your credit score is NA (not applicable)/NH (no history).

- 300 -549 : AA credit score in this range is considered as a bad credit score. It suggests that you have not been a responsible borrower and have defaulted payments and have unpaid dues.

- 550-649 : A credit score in this range is considered as average. You will need to take measures to improve your credit score.

- 650-749 : A credit score in this range is considered as good and lenders will consider offering you credit in the form of a loan or a credit card. However, you might still not be in the position to negotiate a good deal.

- 750-900 : with a credit score in this range, lenders will be willing to offer you a loan with cheaper interest rates. A credit score in this range also gives you the additional power to negotiate for a better deal on interest rates and credit cards with better rewards and benefits.

Who computes credit score?

Your credit score is computed by credit information companies. There are four companies in indian which do the job– CIBIL transunion, experian, equifax and high mark.Let’s unveil the mystery around how these companies compute your score.

When you make a transaction—the one that is relevant to determine your score—banks send details about it to all four credit bureaus. To send details to all credit agencies is a mandate by the RBI. Essentially, banks keep credit information companies up-to-date about your monetary habits. If a bank needs to check your credit score, they can approach any one of the bureaus. It doesn’t matter which one because all will have the same score for you– all four are equally authoritative and on par with each other.

After receiving information from the bank, credit bureaus get down to the task of collecting more information about your financial habits from other banks and financial institutions. The credit bureaus then processes this information to formulate what is called a credit report.

Now, what is a credit report? A credit report is your financial marks card. It contains your credit score. It’s wiser to check your score from time to time.

Why should I check my credit score?

It is very important that you keep a close eye on your credit score. It is the best way to gauge your chances to get a line of credit. Another reason why you should track your score is to know if it dips, or if an error has been made by credit agencies while calculating your score. This will help you make timely amends.

Why is bankbazaar giving me my credit score for free?

Bankbazaar feels that you should always be in complete command of your personal finances. In order to help you with this goal, we have made provisions for you to check your credit score for free. Knowing your credit score before applying for a loan can help greatly.

If you have a good score, you can be rest assured that your loan or credit card application will be processed without any hassle. You can even leverage a good score to ask your lender bank for better rates of interest and additional benefits. On the other hand, seeking credit with a poor score will further lower your score. Let’s not even imagine getting approval for a credit line. Hence, check your credit score before you apply for a financial product. Work up the score if it’s not in the acceptable range.

TIP: credit agencies review and renew your score every few months. If you have a poor credit score, start managing your money wisely and pay your dues on time for a good few months. Credit agencies will reward you by boosting your score.

Does my credit score get impacted if I enquire about it?

It depends on the kind of enquiry being made. There are two types of enquiries – hard and soft enquiry. Hard enquiries send your credit score down by a few points, while soft enquiries do not impact your credit score.

An enquiry made by an individual is called a soft enquiry. Bankbazaar will make a soft enquiry on your behalf when getting your credit score from experian. Hence, this will not impact your credit score in any manner. Moreover, checking your credit score on our website is free!

A hard enquiry is when a financial institution checks your credit score to take a decision on your credit application. Every time you apply for a loan or a credit card, the lending institution checks your score. Each time a bank checks your score, your score will dip by a few points.

TIP: if you are applying for a loan or a credit card, do not apply to many banks at the same time. Too many enquiries will hurt your credit score.

Credit score/credit report

What hurts your credit score?

It is understood that having high balances on your credit cards can significantly reduce your credit score. Apart from that, there are several other factors that can hurt your credit score:

- Being late on your credit payments.

- Completely ignoring your loan dues/credit card bills.

- Creditors charge off accounts when credit card bills are not paid on time. The status of having your account charged off is one of the worst incidents that reflects on your credit score.

- Lenders use third-party debt collectors to retrieve the loan amount from you, in case they do not receive payments. Having your account sent to collections reflects very poorly on your credit score.

- Filing for bankruptcy can have a devastating effect on your credit score.

- When you request to close a credit card that has an outstanding balance, your credit limit drops to rs.0. This is similar to a situation where you have maxed out your credit card.

- Closing old credit cards shortens your credit history. This has a negative impact on your credit score.

- Applying for multiple credit cards or loans within a short duration makes your credit score plunge. Hence, it is advisable to limit the number of applications.

- Having only one type of credit account will negatively impact your credit score. So, you should look to maintain a mix of loans and credit card debts and make consistent payments on time.

- If you fail to check your credit report occasionally and fix errors, if any, your credit score can be hurt. It should be understood that credit reporting bureaus also make mistakes while creating credit reports. If you do not monitor and correct your report, it may cost you a lot in the future.

Calculation of credit score

Credit bureaus in the country compute credit scores after taking into consideration several factors such as your credit history, repayment behaviour, and credit type, among others. There are four credit bureaus in the country - transunion CIBIL, experian, equifax, and CRIF high mark. They are licensed by the reserve bank of india (RBI). The financial institutions in the country send your credit details on a monthly basis to these bureaus. Each credit bureau has its own algorithm and method of calculating scores.

Let’s take a look at the four main factors and their impact on your credit score:

Benefits of a good credit score

If you have a good credit score, you can avail loans and credit cards faster and with ease. Check yours now!

Get the best credit card - A good credit score may get you the best of credit cards. Get a feature-loaded card and reap the benefits.

Quick loan approval - A good credit score works like an expressway for your loan application. Banks may approve your application quickly and readily.

Better interest rate - with the backing of a good credit score, you can bargain for a lower rate of interest on loans and credit cards.

Loans made more affordable - loans come saddled with processing fees and many other charges. You can bargain your way out of some of these charges with a good credit score.

Check your credit score right away and see if you are eligible for all these benefits. You can check your score on bankbazaar at zero cost.

4 credit score secrets

Credit score is one of the most misunderstood topics in the financial book. Here are four secrets to help you understand your credit score better.

Credit score ? Credit report

Your credit score is calculated based on information present in your credit report. Your credit report presents details about your credit accounts, credit application and debt repayment, among others.

Checking your score will not hurt it

When you or a company enquires about your credit score, it’s called a soft enquiry and it does not hurt your credit score.

Credit score math

There are five prime factors that go towards deciding your credit score. They are - debt repayment, credit utilisation ratio, average credit age, type of credit account (secured / unsecured) and credit score enquiries made.

Keep an eye on fraud

You did nothing wrong and yet your credit score is low? Please go through your credit report thoroughly and immediately report any unauthorized activities to your bank to correct your score.

It’s important that you check your credit score regularly. Bankbazaar has partnered with experian and we will fetch your credit score at no cost. It’s just a matter of a few minutes.

Healthy credit score crucial in 2018

Given the interest rates edging up this year, maintaining a healthy credit score is vital. Credit score directly influences whether you will be eligible for a loan and how much interest you will be paying back. Higher the credit score, lower is the interest rate and the vice versa. Any lender before approving a loan application or credit card application analyses multiple factors and one of the major aspects is checking the credit score that can drastically drop the chances of the loan getting rejected.

If the lender assumes you as risk borrower even though they will approve your application, but the chances are high that the interest rates will be tremendously high. So, before you plan to get an application approved keep a track of your credit score on regular basis either by taking free CIBIL score or subscription based CIBIL score. Scores normally range from 300-850. While above 750 is considered as a good credit score and can get your application approved in lower interest rate, scores below 750 shows your defaults that can increase your interest amount. If your score is below 550 chances are high that you loan application may get rejected. So, track your credit score for free from the various credit bureaus.

What is a free experian credit score?

List of credit information companies in india:

- Transunion CIBIL limited: (earlier known as - credit information bureau (india) limited) is the first credit information company (CIC) of india that was founded in august 2000. The company collects and maintains records of an individual’s repayment habits related to loans and credit cards. These records are sent to transunion CIBIL limited by the member banks and financial institutions on a monthly basis. The information received from these establishments are used to create credit information reports (CIR) and credit scores. These reports and credit scores are provided to lending institutions such as banks in order to help them make lending decisions.

- Experian credit information company of india private limited: with headquarters in dublin, republic of ireland, experian uses its own methods of calculation to create credit reports. The credit report from experian has information of an individual's credit and loan history that are bought as credit reports by various banks in india. Similar to transunion CIBIL limited, experian collect information from the member banks and other establishments. The lenders are required to pay a fee to obtain credit reports from experian.

- Equifax credit information services private limited (ECIS): one of the oldest credit information companies of USA, equifax is also the largest credit reporting agency in the US. Headquartered in atlanta, equifax provides credit reports for individuals as well as businesses. Equifax has tied up with various banks and institutions in india that help the company in creating credit reports and assessing credit scores.

- CRIF high mark: considered to be one of the few credit information company that specializes in analytics, scoring, and credit management solutions. CRIF high mark creates credit reports based on the information collected from banks, income tax department, and other banking as well as non-banking companies. The credit reports from CRIF high mark are available against a fee. There are many indian banks who have tied up with CRIF high mark to create reports and to assess their borrower's financial credibility.

Why credit reports are used?

- Determining creditworthiness

- Reviewing missed/late payments

- Checking the credit score

- To analyze all credit and loan accounts under one platform

- Reporting errors on the report

- Making effective landing decisions, etc.

The application process for obtaining your credit report

Most cics offer credit reports through online and offline mediums. The individual will require producing of required details and make a payment to get his/her credit report.

The following documents and details are required for obtaining a credit report online:

- Name

- Date of birth

- Address

- PAN card number

- Identity authentication

The following documents and details are required for obtaining a credit report offline:

- Visit the CIC's site to download and fill out the form requesting for your credit report

- Self-attested and scanned copy of any of the proof of identity (poi) such as PAN card, driving license, etc.

- Enclose a demand draft (DD) that is payable to the relevant CIC for the required fee

- Mail the documents along with the DD to the address mentioned on the CIC's website

What is the difference between a credit score, credit rating, and a credit report?

| Credit report | credit score |

|---|---|

| your credit report has information on the current and past credit agreements that you hold. These include mortgages, credit card accounts, student loans, and inquiries on your credit history. | A credit score is similar to a grade that is provided to your credit report. It is a 3-digit number that usually ranges from 300 to 900. |

| The credit report is a reflection of your credit management, and you have control over the listings there. | The credit reporting bureau assigns you the credit score based on your credit history. |

| The credit report gives an outline on how much you owe your creditors over an extended period of time, whether you have been making payments consistently, and for how long each account was open. The report also lists associated public records against you, such as court judgements, bankruptcy filings, etc. | A high credit score indicates that you are a low risk borrower, making you more likely to qualify for a loan. |

| In order to access your credit report, you can get in touch with credit reporting agencies or use a credit monitoring service that offers you this information. | Your credit score is a part of the exhaustive credit report that you receive from the credit bureau. |

Importance of credit reports for companies and businesses

Similar to individual credit reports, the cics prepare credit reports and assign credit ratings to businesses and all other types of firms. The credit report for businesses is closely reviewed by suppliers and government agencies while providing utility and business contracts.

The credit reports for businesses provide information related to the establishment, owners/directors, employees, profit and loss, liability, assets, pending court cases (if any), and various other details. These type of credit reports can be expensive based on the amount and type of information it offers.

Understanding the credit reports through key terms

NA or NH: if you never owned a credit card or took a loan, there are chances that you will see an NA or NH on your credit score. NA or NH indicates that are there no, little, or insufficient credit activity to create a report or to generate a credit score.

STD: applicable to an individual's credit report where the payments are made with the due dates.

SMA: applicable on a credit report when the borrower has delayed the repayments.

DBT: this indicates a doubtful situation where the credit information has been inactive for over 12 months.

LSS: A credit report can be remarked as LSS if a lender reported the loan/credit card account as loss or if the account remains as a defaulter for a longer period of time.

DPD: days past due (DPD) indicates the number of days that the account has not received a payment. Written off/settled status: in a situation where the borrower could not make the repayment but came to an agreement with the lender for either a repayment plan or a settlement will indicate a written off or settle status.

Reading a credit report

A credit report is a detailed account of a person’s credit history. The credit report will include details of your credit accounts, like, credit cards, auto loans, home loans and any other form of credit availed from a registered lender. The credit report will also include details like payment history, credit limit and account balance, opening date of credit, status of loans (close or open, paid in full, not paid in full). The report will also include new credit inquiries, collection records and public records, for cases in which an individual has filed for bankruptcy or a tax lien. A credit report can seem like quite an intimidating document to read, but listed below is a section-wise breakdown of how a person should read his/her credit report:

Personal information : this section of the credit report will contain information pertaining to the individual’s identity, such as, the person’s name, address, current and previous accounts, date of birth, etc. An individual should check the details provided under this section, if there is an incorrect address in the report or the person’s name has been misspelled, he/she should report this to the credit rating agency (CRA) as this could be a sign of wrong data being reflected in the report or credit fraud.

Account information: this section of the credit report will carry information pertaining to the person’s present and past credit account. The individual should check the details of this section carefully as this is quite a detailed section. The following details should be checked:

- Date of opening

- Name of creditor

- Current balance

- Highest balance/credit limit

- Monthly payment history

- Account type (instalment, revolving, open)

- Account ownership (individual or joint)

- Payment status

Public records: this section of the credit report will list and bankruptcies filed by the individual, tax liens availed by the individual or collection accounts. The dates provided in this section should be checked as they will directly affect how long they will appear on an individual’s credit report and affect the person’s credit score.

Inquiries: this section carries data pertaining to any inquiries made by companies regarding an individual’s credit score. If an individual applies for multiple lines of credit, this could affect his/her score negatively. In most cases inquiries do not affect a person’s credit score, as they are soft inquiries by lenders for promotional purposes. A soft inquiry is generated when the request for the credit report is not related to the individual’s request for credit.

T.I.P.S. To get a great credit score

A great credit score is anything above 800. If a bad credit score is the bane of your life, you can use the following tips to send it soaring. Want to know your score?

Keep your credit utilisation ratio at 30% for a good credit score. If you are struggling to stay within this limit, then get a card with a higher top limit.

Seek variety

A combination of secured and unsecured debt will send your credit score upwards. A credit card is an unsecured debt whereas a car loan is a secured debt.

Advantage of old credit card accounts

Think twice before you close an old credit card account as long running accounts add more value to your credit score. And if you are not using your card, keep it safe to prevent misuse or fraud.

5 credit score myths that you should be aware of

When it comes to credit reports, scores, or any debt in general, traditional perception is often seasoned with myths and misinterpretations. So you should not let that information influence your financial conduct. You should understand that credit is a financial tool/facility like any other. Its neither good nor bad on its own. The way in which you use it is what gives it a good or a bad flavour.

Listed below are some of the most common myths about credit that you should know:

You will not receive credit if you do not already have it

When you approach a lender for a loan, four elements of your credit report are analysed:

- Account history

- Identification

- Inquiries

- Public records, such as court records or bankruptcy filings

If there is no established credit history for you, you just have to get someone to co-sign or authorise your loan. In case you do not have someone who can co-sign for you, you can explore the option of getting a secured credit card. This type of card requires you to put up cash as collateral. Once you start using the credit card, you will be able to establish a credit history. It is important that you make payments on time and use credit conservatively. Be patient, as it will certainly take time to build a credit history. Once your credit history is periodically evaluated, if you have a good standing, your credit score will increase.

Checking your credit report will negatively impact your score

If an individual accesses his/her own credit report, it will not have a negative impact on the score. In fact, it is a healthy practice to check your credit report at least on an annual basis. Reviewing a report results in a “soft inquiry” that will only be reflected in a personal credit report. When a lender reviews the credit report, a “hard enquiry” will be added. These hard enquiries are shown to other lenders who review the report in the future, as these may represent new debts that are not yet visible on the credit report. Too many hard enquiries can have a negative effect on your credit score.

Once your credit score is bad, it is not possible to rebuild it

A bad credit report can be rebuilt over time. The report shows all credit issued under the consumer’s name. It also shows all items that are closed or inactive. If you have missed payments or have made late payments, it can remain on your credit report for up to 7 years. In this time, you can rebuild your credit report by paying your dues on time, looking for better credit choices, and being judicious while spending. You have to remember that an old negative information in the report is less important than a recent positive one.

The government owns credit reporting agencies

Credit bureaus are not owned by the government. However, the government has laid down many laws on how these should operate.

Paying in cash always helps to improve credit rating

Using cash for all payments is certainly not better than using credit responsibly. This is because a consumer has to develop a credit history (displaying responsible credit usage) in order to establish a good credit score. If a consumer does not hold various types of credit accounts, his/her credit score will not be as good as another individual with a history of responsible credit usage.

Faqs on credit score/ credit report

The PAN card is required for obtaining the individual’s score accurately. The credit score can also be obtained by using other valid proof of identity (poi) instead of the PAN card. The poi helps in identifying individuals in the database.

Can credit score inquiries affect the score?

No, the inquiry will not affect your credit score. When you apply for a loan or a credit card, it can have a slight impact on your credit score but when you are checking your credit score it is not.

Why do we need a phone number for credit score?

The phone number helps in identifying individuals accurately. Your credit report will already have your phone number, when you provide your phone number, it is verified against your records to ensure you are the right recipient for your credit score.

Is there a limit to request for accessing credit score?

There are no limits to the inquiry of credit score. You can check for your credit score as many times as you need to. The inquiry for the credit score is considered as a soft check while only hard checks can impact your credit score.

How the credit scores changes?

The credit score depends on the credit report changes, as and when the changes are made to the credit report, the credit score would change depending on the positive or negative impacts. For example, when you are applying for a credit card or loan, making payments towards the credit, it will impact your credit report and the score.

What is the significance of credit score range?

The credit score range can vary depending on the assessor, however, the value will represent the same level of creditworthiness. The credit score summary will also indicate the health status, it will tell you if a particular score is excellent, good, average, or poor.

What can be considered as a good credit score?

Credit score may vary based on the credit rating company. The credit report and score will provide you with an indication of whether you have a good or bad score. A good score with a particular assessor will more likely to have a good score with another assessor.

What are the factors that are included in the calculation of credit score?

There are few factors that are considered while calculating an individual’s credit score. Primarily, the account information that includes information of credit cards and loans, the public records containing information pertaining to tax lien and bankruptcy, and the hard inquiries made by your lenders will be accountable for the calculation of credit score.

Will the credit score be affected for owning multiple credit cards?

This will depend on your credit history. If you have multiple credit cards with a higher limit and you are under-utilizing or over-utilizing it, this can impact your credit score negatively.

What type of information is included in my credit report?

The following information will be included in your credit card report:

- Individual’s name, address, and other personal details

- PAN card and contact number

- Credit history

- Credit cards/loans

- Payment patterns

- Lender’s inquiry details, and more

A credit report won’t contain any information related to your checking or savings accounts. Also, the information pertaining to criminal records, medical history, lifestyle, and other details are not included in the credit report.

How long does the information remain on a credit report?

This will depend on various factors such as the inclusion of hard inquires, payment details, credit card, and loan applications. As soon any changes are detected, your credit report would change. The information is obtained on a monthly basis for the changes to be implemented. If you find any error on your credit report, you are recommended to get it corrected from the assessor.

Is it possible to delete information from the credit report?

Unless it is incorrect, no details can be deleted from your credit report. The credit report provides an insight of your credit history and lending worthiness. Most lenders vastly depend on the credit reports to assess the lending risks.

What do I need to do to if I find errors on my credit report?

If you notice any error or wrong entries in your credit report, you can get in touch with the credit report provided to get it rectified. The process is simple, you can get in touch with your credit report provider through phone, email, and other mediums.

Is the credit information report same as the CIBIL score?

No, the credit information report contains details of credit history and inquires, CIBIL, like various other credit rating companies have their own method of calculating the score based on the information on the credit report. The credit information report has all the details of an individual’s credit date while the CIBIL score indicates the credit worthiness. The CIBIL score is derived from the information available in the credit information report.

Who can access my credit report?

Your credit report can be accessed by you, lenders, and government recognized regulating bodies.

Why do lenders check the credit score?

The lenders refer to the credit score to determine the credit worthiness of individuals. It helps the lenders or the banks to understand the risk factors involved in lending out money to an individual.

Can the CIC (credit information companies) change or delete my credit information?

No, the CIC collects information from various financial institutions but doesn’t change any data. The CIC compiles information related to credit transactions and payment histories of an individual.

What’s the credit score required for application of a credit card?

A score of 700 and upwards has a higher chance of approval for credit card application. The banks might hesitate to give you a credit card if the score falls under 700.

How can I improve my credit score?

There are many ways by which you can improve your credit score. Some of these ways are maintaining payment of loan emis and credit card bills. Along with this, limited borrowing and maintaining a credit utilisation ratio of less than 30% can also help your score.

What is the highest score you can get on experian?

Experian’s credit score ranges from 300 – 900. 900 being the highest score.

Can I have more than one credit report?

Yes, credit reports contain your overall banking history and are used to assess your credibility, which is your credit score. A free copy of your credit report can be obtained once a year from each of the credit rating agencies that include CIBIL, mark high, experian, and equifax. You can also request for obtaining all the credit reports at once.

How can I build credit with no credit history?

A sound credit history is useful to apply for a loan. It shows how effectively you have managed to repay the earlier obligations. If you have never used a credit card or never borrowed a mortgage, your credit history stands nil. Lenders may not issue a credit card or prolong a loan. Consider the following ways to build credit with no credit:

- Obtain a secured credit card

- Make payments in time

- Use your credit card wisely

- Restrict yourself applying for various bank loans

- Track the progress of your credit score and credit reports periodically

Yes, you can. Over 8 million adults are affected by identity theft every year. Review your credit reports once a month. Be safeguarded by obtaining an updated credit report to review for any doubtful fresh accounts. Observe the below cited general identity theft signals on your reports.

- Unanticipated usage of old credit accounts

- Wrong personal details

- Unknown credit accounts and credit cards

News about credit score

CSC partners with transunion to provide CIBIL score

The common service centre (CSC) has partnered with transunion CIBIL ltd. To provide the CIBIL score. The new partnership will provide access to individuals in rural areas, where over 2.5 lakh cscs are present. Cscs allow individuals to avail bank loans quickly for their personal and entrepreneurial needs. Lenders access the CIBIL score to check the individual’s financial health and credit worthiness. Lenders use this data before loans are provided. Individuals will have to go through the authentication process in order to get the CIBIL score via cscs. The report can also be downloaded. According to the chief executive officer of the CSC, dinesh tyagi, individuals in rural areas lack awareness about the CIBIL score. Customers who have a good credit score can negotiate for better interest rates.

India’s cut in credit rating

India’s credit rating has moved one step closer to junk after moody’s investors service had downgraded the country to a low investment grade level and had also surprised the economists.

Moody’s had reduced the long-term foreign-currency credit rating to baa3 from baa2, and this implies that it can get cut further. This action brings it in par with the BBB- assessment from fitch ratings ltd and S&P global ratings. The economy is now facing a huge contraction in over four decades.

RBI rate cut followed by increased credit growth by 100 bps

The credit growth of all commercial banks had grown around 7% on 10 april to rs.102.85 trillion. This was the data that had been gathered from the reserve bank of india (RBI). On 27 march, the RBI had reduced the repo rate by 75 bps for stimulating growth, after which the banks also lowered their deposit rates and lending rates.

This is an improvement from the 6% credit growth that had been seen in the previous fortnight ended 27 march. Credit growth has been reducing for the past few quarters and has been expected to reduce further because of the coronavirus that has disrupted all credit disbursals. The lenders from the public sector are now trying their best to push the covid-19 emergency credit lines to all their borrowers. It had been reported n 26 april that all branch-level officials in public sector banks are now having difficulty in managing the superiors’ expectations on higher credit growth. In a few cases, the branch officials have also learned that the demand for fresh credit has reduced drastically and this has brought almost all loan disbursals to a standstill.

Care ratings had said that the credit growth in the banking sector has remained moderate since september 2019 after it had recorded a double-digit growth by the end of the quarter june 2018. The RBI data says that the bank deposits have increased during the 10 april fortnight, as compared to the 27 march fortnight. The deposits had grown at 9.45% y-o-y during the 10 april fortnight, and it had been growing at 7.93% during the previous fortnight.

CRISIL revises credit rating of BASF india

CRISIL has decided to put the rating of CRISIL AAA to the non-convertible debentures of BASF india under rating watch with negative implications. The move to do so is been seen as an emerging situation which may affect the credit profile of BASF india. It must be noted here that the ratings on fixed deposits have been reaffirmed at ‘FAAA/stable’ and that of commercial paper at ‘CRISIL A1+’. CRISIL is a global analytical company providing ratings, research, and risk and policy advisory services.

Slowing credit growth poses challenge for indian banks

Staggering credit growth is a huge challenge that the banking industry is now facing in india. The reserve bank of india governor shaktikanta das had said that it is crucial that banks focus on prudent lending. The credit growth in india has moderated to 7-7.5%.

He had added that the main challenge in india is a slow credit offtake and this, in turn, affects the profitability of all banks in the nation. In order to facilitate a faster flow of credit, the RBI has now taken a lot of steps. These include reduction in repo rate, provision of long-term repo operation and facilitation of bank refinance to nbfcs. These measures will help in boosting the operational efficiency of banks. The governor had said that the performance of a banking system lies on the strength of its corporate governance. He had added that the RBI can lay down a few rules and guidelines but eventually the responsibility lies on the banks.

The RBI will be issuing the draft guidelines on corporate governance in the private and public sector banks. The governor had also added that the RBI's aim is to improve the efficiency of its regulatory and supervisory functions. While talking about nbfcs, he had said that credit flow to all small nbfcs has been increasing over the past year. A lot of aspects of top 50 nbfcs like the asset-liability management (ALM) position are now being assessed and monitored. This includes all nbfcs that have assets above rs.5,000 crores.

India witnesses an increase in credit conscious women

Reports from credit bureau indicate that women are getting a lot more credit conscious as compared to men. Lenders now prefer to lend to women as there is a higher chance of them repaying loans.

Between the age group of 36 and 50, the number of women borrowers have boosted by 33% since december 2017. A study by credit bureau crif highmark has revealed that the number of women borrowers over the age of 50 has increased 41%. A study by credit bureau transunion cibil shows that the self-monitoring rate among women has increased by 62%. This means that more women are frequently assessing their credit score and becoming more credit conscious.

Around 56% of the self-monitoring women are from tamil nadu, telengana, karnataka, delhi and maharashtra. Sujata ahlawat, VP and head of direct-to-consumer interactive, transunion cibil had said that women have a better credit profile than male counterparts. This will, in turn, translate into wider access to credit and also faster and more efficient loan approvals

Bank credit growth falls 8.5% in january

According to reserve bank of india (RBI) data, bank credit growth slumped by 8.5% for the month of january from 13.5% a year ago due to sharp slowdown in loans to the retail service sector.

Growth in advances in the service sector fell from 23.9% to 8.9% in january 2020. However, personal loan segment during the month grew 16.9%, while credit to housing loan grew by 17.5% to 18.4%. Education loan during january declined by 3.1% in comparison to the negative decline of 2.3% in january 2019. Credit growth fell from 5.2% to 2.5%.

Government banks pulled by RBI governor for poor credit growth

Shaktikanta das, the governor of the reserve bank of india, has encouraged banks in the public sector to enhance their credit growth. Reports suggest that the central bank had said that it was not satisfied with the muted credit growth in banks. According to the latest data released by the reserve bank of india, the credit growth fell by 8.5% in january, marking a stark decline from the 13.5% recorded in january last year. The reserve bank also encouraged banks to make the most of the long-term repo operations window in order to ensure that credit is pushed to certain sectors, and ensure that it is not used for treasury operations and the like. Many public banks are currently sitting on heavy liquidity and the LTRO window is not being used. The reserve bank of india, in its february policy, had made an announcement according to which a 1 lakh crore long-term repo auction would be available for lenders to borrow 1 and 3 year loans at repo rate. The central bank also asked for a report on the cases resolved under the june 7 circular that it had issued on stressed assets.

Bank credit growth to rise 200-300 bps by next fiscal

Crisil has just announced that they expect bank credit growth to shoot up and rise 200-300 basis points by the time the next fiscal year. The share of retail loans in the bank credit will rise 400 basis points up till 28% till march 20201.

The credit rating agency also mentioned that the market would see corporate loans go through anemic growth during the current fiscal year. Economic activity in the market is slowly picking up pace. The overall demand for retail loans are also shooting up.

This trend promises a better credit growth for the next fiscal year. The rating agency had said that the slowdown in bank lending during this fiscal have bottomed out and the gross credit will boom to 8%-9% in 2021.

India's GDP for 2020 and 2021 cut down; analysts say credit growth and demand to play critical roles

The GDP forecast of india has been cut down to 5.4% for 2020 and 5.8% for 2021 according to moody’s. The original GDP of the country for the current year and the next was 6.6% and 6.7% respectively. Moody’s has also revised the global GDP to be cut down due to the effect of the coronavirus over the economy.

G-20 economies are expected to grow at 2.4% in 2020 which is a lower rate when compared to the previous year followed by 2.8% in 2021 according to a report by moody’s. The growth predictions for china as well have been lowered to 5.2% in 2020 and expect to maintain the growth of 5.7% in 2021.

The growth projections of mexico and south africa is also said to be lowered like india due to the domestic issues the countries have been facing along with the constant external factors playing a direct role in the economic growth.

According to experts, the revival of domestic demand in rural and urban areas would be a key factor to strengthen the economic momentum of the country. Credit growth resumption, according to moody is essential for the economy as well.

So, let's see, what we have: instantly get your free credit score in seconds. Monitor your score, and learn about ways you can improve your credit score. At free credit scr

No comments:

Post a Comment